The Relationship among Real Exchange Rate, Current Account Balance and Real Income in Kenya

Boniface Muriithi Wanjau

Abstract

Persistent current account deficit is a chronic problem in many developing countries including Kenya. In an

attempt to understand disequilibria dynamics in Kenya, this study sought to investigate the effect of real exchange

on current account balance and additionally investigate whether the rate of import growth in Kenya is consistent

to balanced economic growth as stipulated in Thirlwall law. The study is based on two main theories, the

neoclassical elasticity approach and balance of payment constraint model. The former contend that balance of

payment is influenced by the nature of import and export elasticities, while the later theory holds that long run

economic growth rate may be achieved if growth of export is consistent with import growth rate. Informed by

aforementioned theories, two main objectives were investigated: First was to determine the effect of real

exchange rate change on current account balance in Kenya. Secondly was to determine the extent to which import

growth rate is consistent with balanced economic growth in Kenya. The first objective was tested by regressing

the trade balance against real exchange rate, foreign income and relative prices, degree of openness and

government expenditure. The significance and signage of real exchange rate coefficient was used to determine

whether Marshal-Lerner condition holds. To test the second objective, elasticity of income was estimated using an

import function and compared to the theoretical income elasticity proposed in the balance of payment constraint

model. Annual time series data from 1980 to 2011was modeled using ARDL model. The data were subjected to

Stationarity test using Augmented Dickey Fuller (ADF) test and Phillip Perron test. Co-integration and Error

correction model was applied to analyze short run and long run dynamic. The model was subjected to

heteroskedasticity test and serial correlation test and an appropriate model used in the estimation. Student t test

and Wald test were used to test for significance and compare hypothesized coefficient respectively. The results

showed that Marshal-Lerner-Conditions hold in Kenya and the J-curve phenomena is supported by data.

Secondly import growth rate is significantly higher than the level consistent with long run growth of the economy.

One of the recommendations is to introduce policies that will trigger increase in demand for export and thereby

drive the economy towards sustainable growth and development.

Full Text: PDF

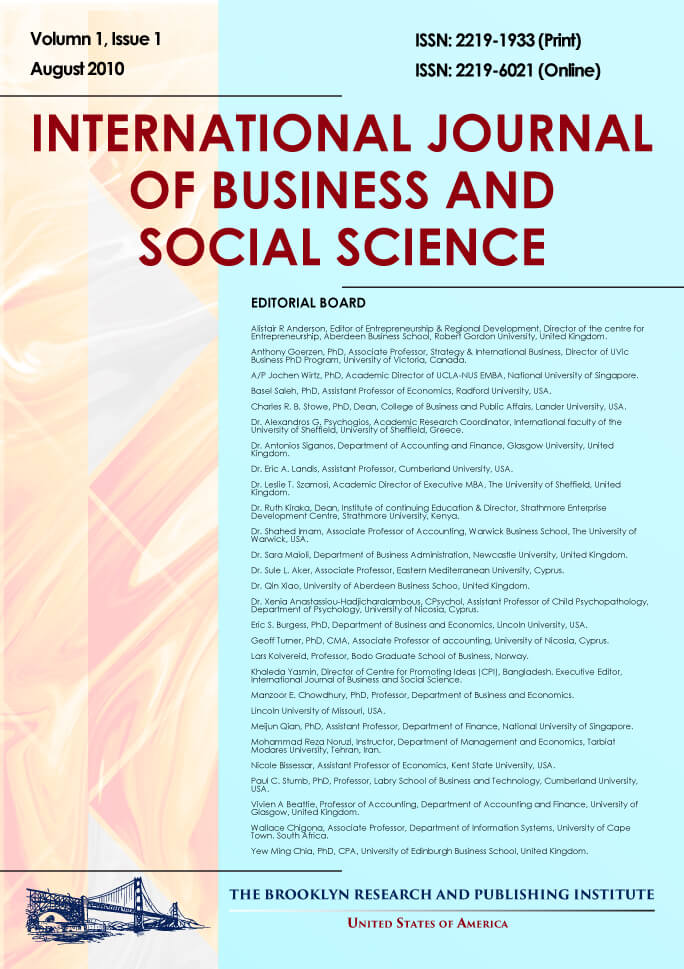

International Journal of Business and Social Science

ISSN 2219-1933 (Print), 2219-6021 (Online) DOI: 10.30845/ijbss

Visitors Counter

27537792

| 5295 | |

| |

19611 |

| |

150393 |

| |

457119 |

| 27537792 | |

| 170 |