Checkbook IRA is the Best Way to Hold Real Estate

Raj Kiani, Ph.D., EA

Abstract

A Checkbook IRA is a power tool for building wealth, but by knowing the facts that by growing your future funds

through investment can be confusing and even scary. The Checkbook IRA empowers you to take control of your

retirement funds and unlock a world of investment opportunities by building retirement wealth through traditional

and alternative asset investments, such as real estate. A Checkbook IRA [ also known as the self-directed IRA

LLC

(Limited Liability Company) or IRA LLC] is a cost effective and time efficient investment vehicle available to selfdirect

IRA investors. In short, the Checkbook IRA will help you: (1) Take control of your future, (2) invest in

what you know, i.e. {buy investment properties such foreclosures, multi-families, and undeveloped lands}, and (3)

eliminate excessive custodian fees.

Since the early 2000s, the number of self-directed IRA LLC “Checkbook Control” has more than doubled! These

plans give individuals the ability to invest into assets that they understand and can control such as real estate.

Investors who have knowledge and expertise in a particular investment can purchase them in a tax-free or taxdeferred

environment. Self-directed IRA LLC “checkbook control” are qualified retirement plans in which the

account holder is the sole investment decision maker. According to IRS regulations, a qualified custodian ( bank,

or trust company) holds the assets of an IRA on behalf of the account holder. The IRA custodian maintains the

assets and all transaction records of the account, files required IRS reports, and perform other administrative

duties on behalf of the account holders.

The purpose of this paper is to explain (a) why the IRA should be invested in real estate, (b) the steps involved in

in establishing a sound Self-Directed IRA LLC with Checkbook IRA, (c) the restrictions (prohibited transaction)

in a real estate IRA and the tax and penalty consequences of incorrect investment in a real estate IRA.

Full Text: PDF

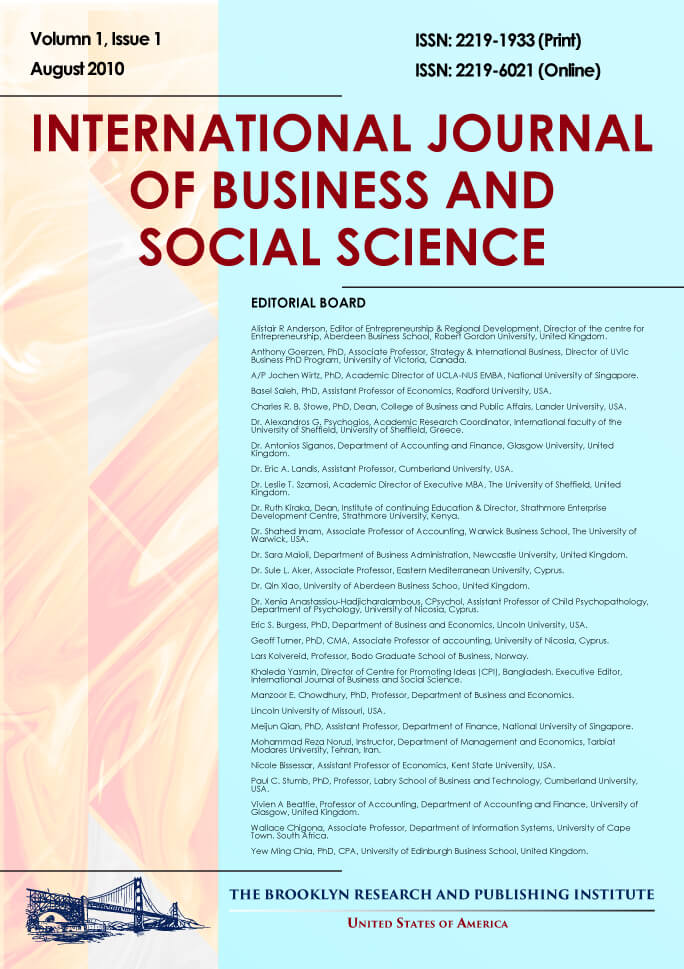

International Journal of Business and Social Science

ISSN 2219-1933 (Print), 2219-6021 (Online) DOI: 10.30845/ijbss

Visitors Counter

28451836

| 3061 | |

| |

23886 |

| |

466981 |

| |

597456 |

| 28451836 | |

| 150 |